OTTAWA, ONTARIO – October 30, 2018 – Thermal Energy International Inc. (“Thermal Energy” or the “Company”) (TSXV: TMG), a global provider of proprietary energy and water efficiency, emission reduction and sustainability solutions to the industrial, commercial and institutional sectors, today announced its financial results for the three-month period ended August 31, 2018. All figures are in Canadian dollars.

Highlights:

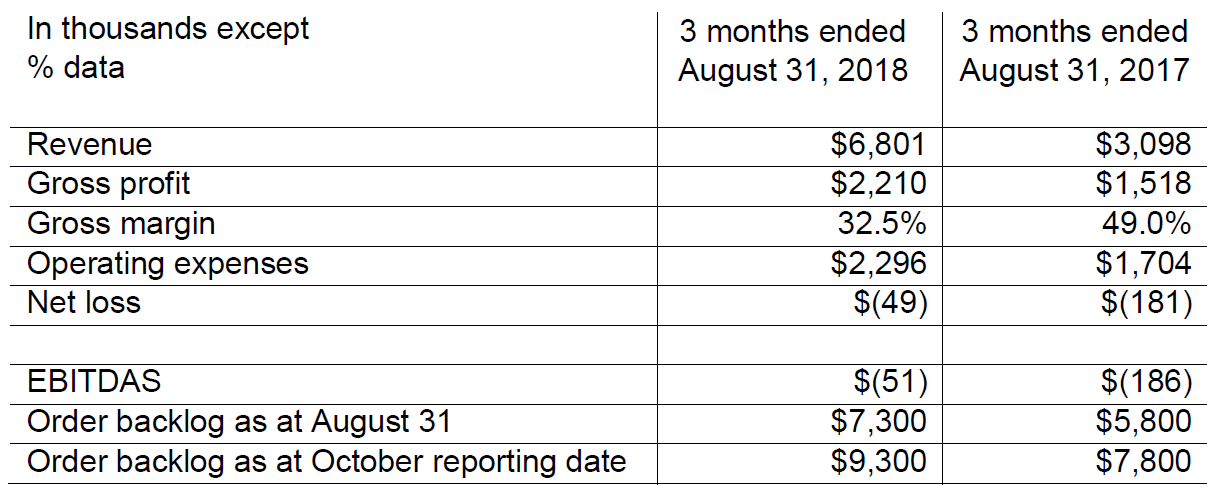

- Revenue increased 120% to $6.8 million;

- Gross profit for the quarter increased 46% to $2.2 million;

- EBITDAS for the quarter was ($50,736), a $135,533 improvement compared to the first quarter last year;

- EBITDAS would have been $167,406, a $353,675 increase compared to last year if we exclude strategic investments in growth and one-time expenses noted below;

- Net loss for the quarter was $49,458, a $131,322 improvement compared to last year;

- The Company had an order backlog of $9.3 million as of October 30, 2018 compared to $7.8 million when we reported first-quarter results last year

“Following our record revenue for all of the fiscal year 2018, we achieved record revenue again for the first quarter of fiscal 2019” said William Crossland, CEO of Thermal Energy.

“The ongoing strategic investments we are making in expanding our team, capabilities and product offerings are clearly beginning to pay off. The acquisition of Boilerroom Equipment Inc. in June not only expanded our offering of complementary products but also gave us direct access to significant new sales channels and provides us with a strong United States base of operations. Last week we announced two orders that moved us beyond our traditional thermal energy efficiency market into the broader water efficiency and sustainability markets. As businesses across the globe search for ways they can reduce operating costs and improve sustainability, they will increasingly be looking to suppliers that have a broad range of sustainability capabilities to identify, recommend, and implement the most advantageous solutions.”

“With a strong order book and our expanded team, product offering and market reach, we are well-positioned to continue our momentum in fiscal 2019 and beyond.”

Summary Financial Results

Q1 2018 Financial Review:

Revenues were $6,800,861 in the quarter ended August 31, 2018, representing an increase of $3,703,277, or 119.6%, over the $3,097,584 recognized in the quarter ended August 31, 2017. The increase in revenues in the current quarter was mainly due to the partial delivery of the $11 million energy efficiency project with the Pulp & Paper Customer announced December 5, 2017, which was approximately 74% complete as at August 31, 2018, plus the addition of the Boilerroom Equipment business effective June 29, 2018.

The gross profit of $2,209,885 in the quarter ended August 31, 2018 represented an increase of $692,088, or 45.6%, from the $1,517,797 achieved in the quarter ended August 31, 2017. The increase was mainly the result of increased revenues. Gross profit expressed as a percentage of sales was 32.5% in the first quarter of FY 2019 compared with 49.0% in the first quarter of FY 2018.

The decrease in gross profit percentage was due to the product split between heat recovery and steam traps. Administration, selling, marketing and business development expenses (“Operating Expenses”) in the quarter ended August 31, 2018 totalled $2,295,743 compared to $1,704,019 in the quarter ended August 31, 2017, an increase of $591,724, or 34.7%. Main increases included one-time costs related to the acquisition of Boilerroom Equipment Inc. ($107,342), the integration of Boilerroom Equipment

Inc’s results into the consolidated results, increased commission payable related to the increased revenue, the strategic investments in the future growth of the company including the addition of new sales and technical staff and additional investments in advertisement and marketing activities ($110,800), plus foreign exchange losses experienced in the quarter compared to foreign exchange gains experienced in the same quarter of the previous year (a difference of $54,644). Despite the increases, Operating Expenses as a per cent of revenue were only 33.8% this year compared to 55.0% last year. Furthermore, excluding the one-time costs related to the acquisition of Boilerroom

Equipment Inc. and the strategic investments to support the future growth of the business, Operating EBITDAS for the quarter was negative $50,736, a $135,533 improvement compared to the first quarter last year. However, EBITDAS would have been $167,406, a $353,675 increase compared to the same quarter last year if we excluded the strategic investments in growth and one-time expenses noted above.

Even including the strategic investments in growth and one-time expenses the Company’s net loss for the quarter was $49,458, a $131,322 improvement over the $180,780 loss recorded a year earlier.

Cash Resources and Working Capital

The Company had working capital of $2.3 million as at August 31, 2018 compared to $2.0 million as at May 31, 2018. Management is of the opinion that sufficient working capital will be obtained from future cash flows by achieving profitable operations through continuing to manage expenditures, concentrating on building upon revenue levels experienced in 2016, 2017 and 2018, and growing revenues at growth rates experienced in the years ended May 31, 2010 through May 31, 2018.

Full financial results including Management’s Discussion and Analysis and accompanying notes to the financial results, are available on www.SEDAR.com and http://www.thermalenergy.com/financial-reports.html.

Order and Backlog Summary

The Company had an order backlog of approximately $9.5 million as of October 30, 2018, compared to $7.8 million when we reported first-quarter results last year. The Company includes in “order backlog” the value of projects in respect of which purchase orders have been received but have not yet been reflected as revenue in the Company’s published quarterly financial statements.

For more information on the products and service available from Thermal Energy International visit www.ThermalEnergy.com.

Notes to editors:

About Thermal Energy International Inc.

Thermal Energy International Inc. an innovative cleantech company and provider of proprietary energy and water efficiency, emission reduction and sustainability solutions to businesses globally. We save our customers money and improve their bottom line by reducing their fuel use and cutting their carbon emissions. Our customers include a large number of Fortune 500 and other leading multinational companies across a wide range of industry sectors.

Thermal Energy is also a fully accredited professional engineering firm and by providing a unique mix of proprietary products together with process, energy and, environmental engineering expertise, Thermal Energy is able to deliver unique turnkey projects with significant financial and environmental benefits for our customers.

Thermal Energy's proprietary products include; GEMTM - Steam Traps, FLU-ACE® - Direct contact condensing heat recovery, Heat-Sponge, SIDEKICK and RAINMAKER – Indirect contact condensing heat recovery systems, and Dry-Rex® - Low-temperature biomass drying systems.

Thermal Energy has offices in Ottawa, Canada, Pittsburgh, USA, as well as Bristol, U.K., Germany, Poland, Italy and China. TEI’s common shares are traded on the TSX Venture Exchange (TSX-V) under the symbol TMG.

# # #

This press release contains forward-looking statements relating to, and amongst other things, based on management’s expectations, estimates and projections, the anticipated effectiveness of the Company’s products and services and the timing of revenues to be received by the Company. Information as to the amount of heat recovered, energy savings and payback period associated with Thermal Energy International’s products are based on the Company’s own testing and average customer results to date. Statements relating to the expected installation and revenue recognition for projects, statements about the anticipated effectiveness and lifespan of the Company’s products, statements about the expected environmental effects and cost savings associated with the Company’s products and statements about the Company’s ability to cross-sell its products and sell to more sites are forward-looking statements. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, some of which are outside of the Company’s control, could cause events and results to differ materially from those stated. Fulfilment of orders, installation of product and activation of product could all be delayed for a number of reasons, some of which are outside of the Company’s control, which would result in anticipated revenues from such projects being delayed or in the most serious cases

eliminated. Actions taken by the Company’s customers and factors inherent in the customer’s facilities but not anticipated by the Company can have a negative impact on the expected effectiveness and lifespan of the Company’s products and on the expected environmental effects and cost savings expected from the Company’s products. Any customer’s willingness to purchase additional products from the Company is dependent on many factors, some of which are outside of the Company’s control, including but not limited to the customer’s perceived needs and the continuing financial viability of the customer. The Company disclaims any obligation to publicly update or revise any such statements except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.