OTTAWA, ONTARIO – April 23, 2018 – Thermal Energy International Inc. (“Thermal Energy” or the “Company”) (TSXV: TMG), a global provider of industrial and institutional energy efficiency solutions, today announced its financial results for the three months (Q3) and nine months (YTD) ended February 28, 2018. All figures in this news release are in Canadian dollars.

Today the Company also announced that it has received a $690 thousand heat recovery order from a new Canadian hospital customer. The heat recovery system is expected to provide the hospital with annual energy savings of $200 thousand, while reducing its annual greenhouse gas emissions by approximately 2,000 tonnes. The project is expected to be completed and revenue earned over the next six months.

With this latest hospital order, the Company’s order backlog is now $16.3 million, more than double the $8.0 million reported at this time last year.

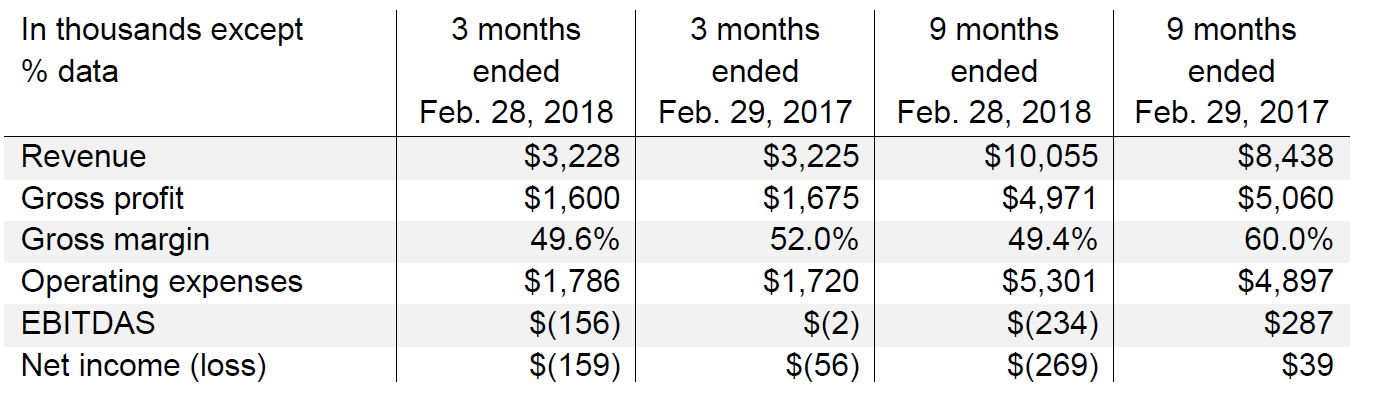

Q3 and YTD Financial Highlights:

- Revenue was $3.2 million for the quarter, in line with a year ago, and up 19.2% to $10.1

million for the YTD;

- Gross profit decreased 4.5% to $1.6 million for the quarter and 1.8% to $5.0 million for the YTD;

- Higher operating expenses as a result of continued investment in growing the Company;

- Net loss was $159 thousand for the quarter and $269 thousand for the YTD;

- The Company had an order backlog of $16.3 million as at April 23, 2018 compared to $8.0 at this time last year.

“Our strong revenue growth of almost 20% for the year-to-date and our exceptionally high order backlog are a testament to our growth strategy and the ability of our team to execute it,” said William Crossland, CEO of Thermal Energy.

“This is tracking to be a banner year for us, and given the strong order backlog, our outlook beyond this fiscal year remains very positive. During the third quarter we received the largest order in our history – an $11 million energy efficiency project with Resolute Forest Products. This did not contribute significantly to our third-quarter revenue, but will boost our revenue from now into fiscal 2019, and possibly early fiscal 2020.”

“We remain focused on growing our business, and to do so we must continue to grow and invest in our team,” added Mr. Crossland. “In my mid-year letter to shareholders on January 29, 2018, I mentioned our plans for hiring a second salesperson for the German market; a technical sales person in Texas to service the gulf coast petrochemical sector; and, an experienced UK-based marketing manager. I am pleased to say that we have since made each of these additions to our team, and are in the process of looking for

additional salespeople in both North America and Europe.

Summary Financial Results:

Q3 2018 Financial Review:

Revenue for the quarter was $3.2 million, which was comparable to the revenue in the third quarter of last year. Sales of heat recovery systems increased 3.8% while sales of GEM™ Condensate return systems were down 5.4% for the quarter.

The third quarter included heat recovery revenues from two ongoing hospital projects, the continuation of a project at a sixth site of a leading Fortune 500 food and beverage producer (announced July 6, 2017), initial work on the co-generation project with the same customer (announced August 31, 2017), and the early engineering phase of the energy efficiency project with Resolute Forest Products (announced December 5, 2017).

GEM revenues in the quarter included further orders from a leading performance materials company, as well as a number of smaller value orders. Gross profit for the quarter was approximately $1.6 million, down 4.5% from approximately $1.7 million in the third quarter of last year. As a percentage of sales, gross profit for the quarter fell to 49.6% from 52.0% in the third quarter a year ago. The decrease in gross profit percentage

resulted from current heat recovery projects carrying lower margins than in the previous year.

Operating expenses for the quarter were $1,786 thousand compared with $1,720 thousand for the same quarter last year. As a percentage of revenue, operating expenses were 55.3% for the quarter, compared to 53.3% a year ago. The increase was attributable to small increases in costs associated with new sales and technical staff, plus the timing of audit fee invoices.

The Company had negative EBITDAS of $156 thousand and a net loss of $159 thousand for the quarter. This compares to negative EBITDAS of $2 thousand and a net loss of $56 thousand in the third quarter of last year.

At the end of February 2018, the Company had working capital of $1.2 million compared to $1.4 million at the end of fiscal 2017. The Company’s net cash position (cash and cash equivalents) decreased to $2.1 million from just under $3.0 million as at May 31, 2017. In addition to its net cash balance, the Company also had an estimated $246 thousand of unused borrowing capacity under its bank loans at the end of the third quarter.

Full financial results including Management’s Discussion and Analysis and accompanying notes to the financial results, are available on www.SEDAR.com and www.thermalenergy.com.

Order and Backlog Summary

As at April 23, 2018, the Company had an order backlog of $16.3 million, compared with $8.0 million a year earlier. In addition to the $690 thousand heat recovery order announced today, and several smaller orders received during the quarter and subsequent to quarter-end, the Company’s order backlog also includes the following orders:

- On December 5, 2017, the Company announced an $11 million energy efficiency project

with Resolute Forest Products. This project represents Thermal Energy’s largest heat

recovery and largest GEM orders to date. While the third quarter included some initial

revenue from the early engineering phase of this project, the project is expected to

contribute to revenue during the remainder of this fiscal year, during fiscal 2019 and fiscal 2020. Once completed, the project is expected to provide Resolute Forest Products with annual natural gas savings of more than 35%, while reducing its annual greenhouse gas emissions by approximately 43,000 tonnes. As at February 28, 2018, $232 thousand of this order had been recognized as revenue.

- During the quarter, as announced on January 29, 2018, the Company received two GEM orders totaling $386 thousand from one of the world’s leading consumer products

conglomerates.

- During the quarter, the Company received a $310 thousand order for a heat recovery

system for a new central laundry facility that will handle laundry for several hospitals. This order was not previously announced.

- Subsequent to quarter-end, on March 26, 2018, the Company announced an $820

thousand heat recovery order from a teaching hospital. The project is expected to be

completed and revenue earned over the next five months. Once installed, the FLU-ACE

system is expected to provide the teaching hospital with annual savings of approximately $220 thousand, while reducing greenhouse gas emissions by 1,007 tonnes per year.

The Company includes in “order backlog” the value of projects in respect of which purchase orders have been received but have not yet been reflected as revenue in the Company’s published quarterly financial statements.

About Thermal Energy International Inc.

Thermal Energy International Inc. is an innovative cleantech company providing proprietary and proven energy efficiency and emissions reduction solutions to the industrial, commercial and institutional sectors worldwide. We save our customers money and improve their bottom line by reducing their fuel use and cutting their carbon emissions. Our customers include a large number of Fortune 500 and other leading multinational companies across a wide range of industry sectors.

Thermal Energy is also a fully accredited professional engineering firm and by providing a unique mix of proprietary products together with process, energy and, environmental engineering expertise. Thermal Energy is able to deliver unique turnkey projects with significant financial and environmental benefits for our customers.

Thermal Energy's proprietary products include; GEMTM - Steam traps, FLU-ACE®

- Direct contact condensing heat recovery, Dry-Rex® - Low-temperature biomass drying systems, HeatSponge - indirect heat recovery units.

Thermal Energy International Inc. has offices in Ottawa, Canada as well as Bristol, U.K., United States, Germany, Italy and China. The Company’s common shares are traded on the TSX Venture Exchange (TSX-V) under the symbol TMG.

For more information, visit our website at www.thermalenergy.com, follow us on Twitter at http://twitter.com/GoThermalEnergy, and on LinkedIn at https://www.linkedin.com/company/thermal-energy-international/

William Crossland President and CEO

Thermal Energy International Inc. 613-723-6776

bill.crossland@thermalenergy.com

Trevor Heisler

Investor Relations

Heisler Communications

416-500-8061

trevor@heislercommunications.com

# # #

This news release contains forward-looking statements relating to, and amongst other things, based on management’s expectations, estimates and projections, the anticipated effectiveness of the Company’s products and services and the timing of revenues to be received by the Company. Statements relating to the expected installation and revenue recognition for projects, statements about the anticipated effectiveness and lifespan of the Company’s products and statements about the expected environmental effects and cost savings associated with the Company’s products are forward-looking statements. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, some of which are outside of the Company’s control, could cause events and results to differ materially from those stated. Fulfilment of orders, installation of product and activation of product could all be delayed for a number of reasons, some of which are outside of the Company’s control, which would result in anticipated revenues from such projects being delayed or in the most serious cases eliminated. Actions taken by the Company’s customers and factors inherent in the customer’s facilities but not anticipated by the Company can have a negative impact on the expected effectiveness and lifespan of the Company’s products and on the expected environmental effects and cost savings expected from the Company’s products. Additional heat recovery and GEMTM steam trap projects being developed by the Company may not result in orders for the Company’s products. The term “backlog” as used in this news release has the meaning given to it above and the Company’s use of such term may not be comparable to “backlog” presented by other issuers who may define such term differently. Orders in the Company’s backlog as described above may not turn into revenue due to many factors, some of which are outside of the Company’s control, including but not limited to the Company’s ability to deliver products on time and in accordance with specifications and the continuing financial viability of the customer. The Company disclaims any obligation to publicly update or revise any such statements except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.