OTTAWA, ONTARIO – January 29, 2018 – Thermal Energy International Inc. (“Thermal Energy” or the “Company”) (TSXV: TMG), a global provider of industrial and institutional energy efficiency solutions, today announced its financial results for the three-month (the “quarter”) and six-month (the “first half” or “year-to-date”) periods ended November 30, 2017. All figures are in Canadian dollars.

- Highlights:

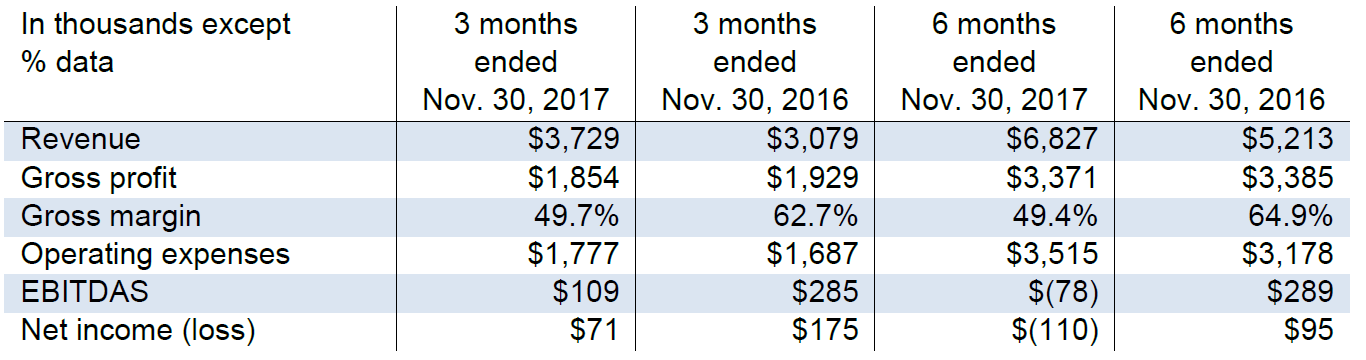

Revenue increased 21% to $3.7 million for the quarter and 31% to $6.8 million for the first half of the year;

- Gross profit is comparable to the same periods a year ago as a higher proportion of heat recovery sales resulted in lower gross margins of 49.7% for the quarter and 49.4% year-to-date;

- Higher operating expenses as a result of continued investment in growing the Company;

- The Company had net income of $70.5 thousand for the quarter and a net loss of $110.3 thousand for the year-to-date;

- Order backlog currently at $17.5 million.

“Fiscal 2018 is shaping up to be a banner year for Thermal Energy International,” said William Crossland, CEO of Thermal Energy. “We are experiencing strong demand for our proprietary energy efficiency solutions and our reported order backlog is at an all-time high. Heat recovery revenue, in particular, was up 132.4% in the first half of the year and we received our largest order on record – an $11 million energy efficiency project with Resolute FP Canada – subsequent to the end of the second quarter. We’ve also had several recent GEM™ orders, including four from two multinational consumer products companies, both of whom are part of our corporate account development strategy.”

Summary Financial Results

Second Quarter Financial Review:

Driven by stronger heat recovery sales, Thermal Energy’s revenue increased 21.1% to $3.7 million for the quarter compared to $3.1 million for the second quarter of last year. Heat recovery revenue was up 108.0% and included the substantial completion of an installation at a major hospital, progress of a project at the sixth site of a leading Fortune 500 food and beverage customer (as announced July 6, 2017), and the partial installation of a system at a leading producer of industrial and fuel alcohols (as announced September 28, 2016).

Revenue from GEM condensate return systems was down 26.0%, despite further orders from a leading performance materials company. The decrease was mainly the result of lower public sector sales.

Gross profit for the quarter was just under $1.9 million, or 49.7% of revenue, compared to slightly more than $1.9 million, or 62.7% of revenue, in the second quarter of last year. Gross margin was affected by the product split, with the second quarter of this year having a much higher proportion of revenues deriving from the sale of heat recovery systems.

Operating expenses for the quarter were $1,777 thousand compared with $1,687 thousand for the same quarter last year. Operating expenses as a percentage of revenue decreased to 47.7% from 54.8% a year ago, despite additional costs associated with new technical and sales staff needed to grow the business.

The Company had EBITDAS and net income of $109 thousand and $71 thousand respectively for the quarter. This compares to EBITDAS and net income of $285 thousand and $175 thousand respectively in the second quarter of last year.

Cash Resources and Working Capital:

At the end of November 2017, the Company’s working capital of $1.4 million was essentially unchanged compared to the end of fiscal 2017. The Company’s net cash position (cash and cash equivalents less bank loans) decreased to approximately $1.8 million from just under $3.0 million as at May 31, 2017. In addition to its net cash balance, the Company also had an estimated $354 thousand of unused borrowing capacity under its bank loans at the end of the second quarter.

Full financial results including Management’s Discussion and Analysis and accompanying notes to the financial results, are available on www.SEDAR.com and www.thermalenergy.com.

Business Update and Order Backlog Summary:

Subsequent to quarter-end, on December 5, 2017 the Company announced an $11 million energy efficiency project with Resolute FP Canada Inc. The project, which included the installation of two FLU-ACE® Heat Recovery Systems and the conversion of the mill’s steam traps to Thermal Energy’s proprietary GEM Steam Trap system, represents the Company’s largest heat recovery and largest GEM orders to date. The project is expected to be substantially completed and revenue earned over the next 17 months.

As part of the Company’s evolving corporate account development strategy the Company recently received four GEM orders totaling $601 thousand from two multinational consumer products companies.

More specifically:

- Subsequent to quarter-end, the Company received two GEM orders totaling $386 thousand from one of the world’s leading consumer products conglomerates.

- During the months of November and December, the Company received $215 thousand in orders from a multinational personal care consumer products company. These orders did not contribute any revenue during the second quarter.

Also subsequent to year-end, the Company received a $120 thousand heat recovery equipment order from a producer and supplier of fresh and value-added food products.

Including the above mentioned recent orders, the Company had an order backlog of approximately $17.5 million as at January 25, 2018, compared to $7.1 million when it reported second quarter results a year earlier. The Company includes in “order backlog” the value of projects in respect of which purchase orders have been received but have not yet been reflected as revenue in the Company’s published quarterly financial statements.

About Thermal Energy International Inc.

Thermal Energy International Inc. is an established global supplier of proprietary, proven energy efficiency and emissions reduction solutions to the industrial and institutional sectors. We save our customers money and improve their bottom line by reducing their fuel use and cutting their carbon emissions. Our customers include a large number of Fortune 500 and other leading multinational companies across a wide range of industry sectors.

Thermal Energy is also a fully accredited professional engineering firm and by providing a unique mix of proprietary products together with process, energy and, environmental engineering expertise, Thermal Energy is able to deliver unique turnkey projects with significant financial and environmental benefits for our customers.

Thermal Energy's proprietary products include; GEMTM - Steam traps, FLU-ACE® - Direct contact condensing heat recovery, and Dry-Rex® - Low-temperature biomass drying systems.

Thermal Energy International Inc. has offices in Ottawa, Canada as well as Bristol, U.K., United States, Germany, Italy and China.

The Company’s common shares are traded on the TSX Venture Exchange (TSX-V) under the symbol TMG.

For more information, visit our website at www.thermalenergy.com and follow us on Twitter at http://twitter.com/GoThermalEnergy

William Crossland

President and CEO

Thermal Energy International Inc.

613-723-6776

bill.crossland@thermalenergy.com

Trevor Heisler

Investor Relations

Heisler Communications

416-500-8061

trevor@heislercommunications.com

# # #

This press release contains forward-looking statements relating to, and amongst other things, based on management’s expectations, estimates and projections, the anticipated effectiveness of the Company’s products and services and the timing of revenues to be received by the Company. Statements relating to the expected installation and revenue recognition for projects, statements about the anticipated effectiveness and lifespan of the Company’s products and statements about the expected environmental effects and cost savings associated with the Company’s products are forward looking statements. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions. Many factors, some of which are outside of the Company’s control, could cause events and results to differ materially from those stated. Fulfilment of orders, installation of product and activation of product could all be delayed for a number of reasons, some of which are outside of the Company’s control, which would result in anticipated revenues from such projects being delayed or in the most serious cases eliminated. Actions taken by the Company’s customers and factors inherent in the customer’s facilities but not anticipated by the Company can have a negative impact on the expected effectiveness and lifespan of the Company’s products and on the expected environmental effects and cost savings expected from the Company’s products. Additional heat recovery and GEMTM steam trap projects being developed by the Company may not result in orders for the Company’s products. The term “backlog” as used in this news release has the meaning given to it above and the Company’s use of such term may not be comparable to “backlog” presented by other issuers who may define such term differently (see further discussion of this non-IFRS measure in the Company’s MD&A for the second quarter ended November 30, 2017). Orders in the Company’s backlog as described above may not turn into revenue due to many factors, some of which are outside of the Company’s control, including but not limited to the Company’s ability to deliver products on time and in accordance with specifications and the continuing financial viability of the customer. EBITDAS is earnings before interest, taxation, depreciation, amortization, impairment of goodwill and other intangible assets, share-based compensation expense and net write-down of lease. EBITDAS does not have a standardized meaning prescribed by International Financial Reporting Standards and therefore may not be comparable to similar measures presented by other companies (see further discussion of this non-IFRS measure in the Company’s MD&A for the second quarter ended November 30, 2017). The Company

disclaims any obligation to publicly update or revise any such statements except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.