For further details, visit Thermal Energy’s Second Quarter and Half Year Fiscal 2020 Financial Summary presentation here:

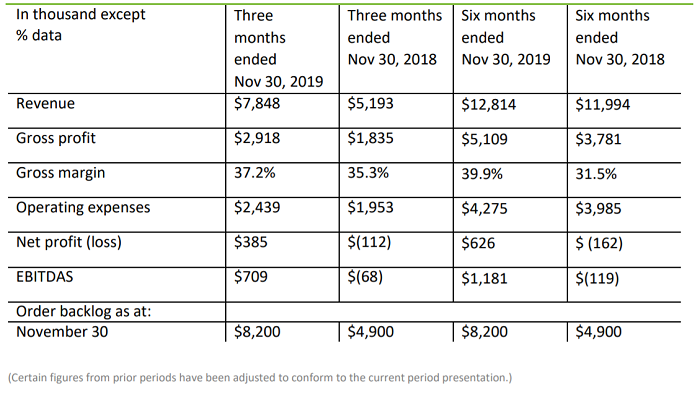

www.thermalenergy.com/presentations.htmlSecond Quarter and Year to Date Fiscal 2020 Financial ReviewQuarterly revenue was $7.8 million, delivering a gross profit of $2.9 million - up 59% compared to the same quarter last year. This resulted in a gross margin of 37.2%. Both revenue and gross profit in last year were impacted by the Resolute project. Quarterly EBITDAS is reported at $709 thousand this year compared to a negative $68 thousand last year, an increase of $777 thousand. Net income for the six months ending November 30, 2019 was $626 thousand, to a net loss of $162 thousand for the same period the year prior. Operating Expenses for the year to date total $4.3 million. Working capital increased by $417 thousand to $2.4 million at November 30, 2019 compared to $2.0 million at May 31, 2019. The Company’s net cash position was $5.0 million as of November 30, 2019, compared to $4.2 million at May 31, 2019, representing an increase of $857 thousand.

Business Outlook and Order Backlog SummaryThe Company ended the quarter with an order backlog of $8.2 million compared to $4.9 million last year, 67% higher than same time last year. The Company defines its order book or backlog as the value of projects for which purchase orders have been received, but that have not yet been fully reflected as revenue in the Company’s published quarterly financial statements. These include:

- A number of heat recovery projects within the food and beverage industry, the value of which totals over $7.7 million, announced between December 2018 and November 2019

- A $1.4 million project to improve efficiency and reducing emissions at an infant milk processing plant, announced in August 2019

- A $2.3 million order to improve energy efficiency for a leading multinational animal nutrition and agricultural products company, announced in March 2019

- A $1.8 million order to implement an extensive HeatSponge heat recovery project for a US dairy group, announced in March 2019

- A $1.3 million order to implement a water recovery system as part of an ongoing sustainability drive for a leading Fortune 500 food and beverage company, announced in October 2018

Full financial results including Management’s Discussion and Analysis and accompanying notes to the financial results, are available on

www.SEDAR.com and

www.thermalenergy.com/financialreports.html.